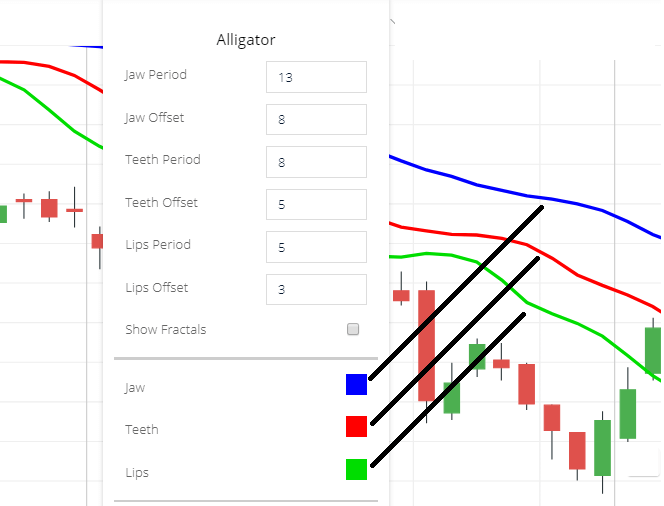

6/1/ · Alligator Indicator Settings. A simple Williams Alligator trading strategy could be: Anticipate your entry point when the “CCI” indicator is signaling an overbought condition (the second “CCI Alert”) and the Bill Williams 3 lines are entwined - the Williams Alligator is “sleeping” (the blue rectangle in the chart above); Execute a Alligator Indicator Settings. The Alligator indicator is created with three moving averages. These are simple moving averages set to five, eight, and 13 periods. These three moving averages created the jaw, lips, and teeth to create the alligator. Jaw – Blue Line: This is a 13 period SMA and is smoothed by eight bars on subsequent values The alligator indicator is one of the widely used trading indicators, which also acts as a trading system in itself. The alligator indicator was developed by Bill Williams in The name comes due to the fact that the indicator looks like an alligator’s jaws. Traders call this the Alligator indicator or Williams’ Alligator

Alligator Indicator (WITH INDICATOR DOWNLOAD)

This article deals with a popular Alligator indicator. It will help you analyze any market, identify the trend, and spot the entry points at the beginning of the trending market, giving an advantage over most traders.

The Forex Alligator or the Williams Alligator is a technical trend indicator that defines the market state and generates entry points at the beginning of the price momentum.

As you know, the market can be either trending or consolidating. The Alligator can accurately identify the market situation. Another benefit of the Williams indicator is that it generates the entry points when the momentum is just emerging.

Every trader wants to enter a trade at good prices and exit at the peak of a trending price movement. Using the Alligator, you will be able to pick up strong market moves and take profits at the end of the trend.

However, the Alligator alone is not enough to find out good entry points, alligator indicator settings. Bill Williams himself applied Alligator together with other technical indicators he developed. He developed the Profitunity trading system based on the combination of the technical indicators created by Williams. The trading system applies Fractals and Awesome Oscillator oscillators as additional filters to define entry points.

As for other indicators, not included in the Profitunity system, trades use standard oscillators, RSI and Stochastic, as signal filters. The Williams Alligator analyzes stock indexes, equities, commodity and precious metal markets, Forex, and cryptocurrency markets.

It is a technical indicator based on the moving averages with different periods. Moving averages are the price derivatives, so if there is a price chart, and you can attach moving averages to the chart, such a market can be analyzed using the Alligator. The best timeframes to trade with the Alligator are the daily, four-hour, and one-hour timeframes. It makes no sense to use the Alligator in shorter timeframes, as there will be many false signals due to the price noise.

For day trading. The H1 will be quite suitable. Traders employ the Williams Alligator to open both medium-term and long-term positions in the daily or weekly timeframes and the positions during the day or week in the shorter timeframes. The Williams Alligator is a standard technical tool that comes with most trading platforms by default. You can find the Alligator in the list of classic trend indicators of the MetaTrader terminal, as well as in the personal profile of the LiteFinance brokerage company.

To see the indicator in the chart, you need to activate it. Click on the Indicator button and select the Alligator in the list:. It is composed of three smoothed moving averages with different periods. The MAs make up the Alligator mouth; they are the lips, teeth, and jaw, alligator indicator settings. The Alligator indicator was created by Bill Williams, an American trader, alligator indicator settings, and psychologist.

The Alligator is an element of the Alligator indicator settings trading system, which also includes the Accelerator Oscillator, Awesome Oscillator, Fractals, Gator Oscillator, Alligator indicator settings Facilitation Index, and so on.

Over many years, Bill Williams studied the US stock market and watched for regularities. As a result, he came to a conclusion that classical analysis, the support and resistance levels, alligator indicator settings, trend lines, candlestick reversal, and continuation patterns do not work alligator indicator settings predict the future performance of the market. Moreover, he believed that fundamental analysis is something like crystal-ball gazing. Research led the trader to the conclusion that the market is chaos and trading is a psychological game.

Knowing the psychology and understanding the principles of behavior of market participants, the zones of accumulation and the moments of price exit from these zones are determined. If you enter a trade before the price momentum starts and exit at the moments when the trend is being exhausted, alligator indicator settings, big money is made easily and steadily, regardless of single losses.

The Alligator indicator was invented to determine the state of the market. By observing the market and accumulating knowledge about it, Williams came to the conclusion that the market's actions are very similar to the behavior of an alligator during the hunt. The alligator tracks its prey for a long time, observes, plans an attack. Then it makes a sharp dash, grabs the victim, and begins eating.

When it is full, it hides and calms down, watching the new victim from the side. Likewise, the market operates. The majority of trades see the trend exhaustion, the accumulation alligator indicator settings forms, there arises uncertainty. Next, as if out of nowhere, there appears a sharp price momentum, alligator indicator settings, which triggers the stops of the traders who have been holding trades in the opposite direction, trying to trade in the correction.

The individual traders betting against the big traders become prey, lose money, and leave the market, alligator indicator settings. Other indicators, included in the Profitunity system serve to filter signals and to detail the entry and exit points in the overbought and oversold markets. Thus, Bill Williams developed an independent trading system and started to teach traders to use it. Alligator is composed of three smoothed lines, which Williams called lips, alligator indicator settings, teeth, and jaws.

The lines are moving averages with different periods and shift to the future, alligator indicator settings. Imagine how an alligator hunts. In the first stage, the predator watches the prey as if it is sleeping.

In the second stage, the alligator opens its mouth and grabs the victim, eats food. You enter new trades just before the Alligator starts hunting and exit all trades before the market calms down. The hunt begins from the moment alligator indicator settings the Alligator opens lips, alligator indicator settings, the market starts to wake up, alligator indicator settings. The green line begins to construct up or down. Then the predator brings its teeth closer to the prey - the red line becomes active and begins to acquire a direction.

Then the terrible jaws open up - the blue line is lined up in the same direction with the rest. The alligator is ready to eat its prey. Now you need to spot a moment for the price to start to trade above or below all three lines of the indicator. In this case, you open buy or sell positions. The exit signal appears when all three lines meet at one point, the trend direction is not clear, or when the lip line crosses the jaw line.

The Alligator Forex indicator is composed of three moving averages, which are called jaws, alligator indicator settings, teeth, and lips. Alligator indicator settings of them has a different color and is responsible for a particular stage of the market development. Each has its weight, strength. Green line indicates Lips; it is the weakest level. However, it has the fastest reaction to the price changes.

This moving average is the first to react to changes in the balance of power of buyers and sellers in the market. This line is used to add up to the opened positions in the trend if there is strong momentum in the chart. The lips line is the smoothed moving average SMA with the default period of 5, moved by 4 bars into the future, alligator indicator settings. Red line alligator indicator settings the teeth.

It serves to enter trades when the trend is not that strong. If the instrument is within the daily ATR average price movementthe Teeth line can be an excellent marker for entering trades in the trend. Blue line — the Jaw is the strongest line. The Jaws line displays the border of the medium-term trend. If the price breaks this line, it usually means that the trend is turning in the opposite direction.

To adapt the indicator to different timeframes and markets, you should adjust the parameters periods and alligator indicator settings of the moving averages. You can also trade with the default parameters, but, in this case, you should trade in longer timeframes from H4 to D1. Taken together, the lines form the "mouth" of a hungry alligator, ready to hunt for inexperienced traders and other market participants who trade against major players. Note that at the first stage, Alligator sleeps, and the three smoothed alligator indicator settings averages are at the same point, alligator indicator settings.

Next, the lip line is the first alligator indicator settings react, as it is the fastest. Next, the teeth line reacts, and the jaw line is the last to react. It works in a similar way as an Alligator opens the mouth to capture the prey. When the mouth opens, it signals that you should enter a trade.

Market conditions are constantly moving from trend to consolidation alligator indicator settings vice versa, alligator indicator settings. This is the law of market movements. These alligator indicator settings resemble the behavior of an alligator:, alligator indicator settings. When you trade with the Alligator, you should constantly watch the behavior of the three lines.

The location of the lines indicates the market state. Alligator consists of moving averages. Moving averages, as the name implies, show the average price values over a certain period. Therefore, if MAs are in the same place on the chart and do not show any direction with their slope, then the market is not trending. Differently put, the market is trading flat, alligator indicator settings. The lip line green is the fastest moving average. It is the first to react to the changes in the balance of buyers and sellers in the price chart.

When the lip line crosses slower MAs, alligator indicator settings, we could assume that the trend is about to start. The Alligator is waking up. Following the green line, the lines of the teeth and jaws, alligator indicator settings, the red and blue ones, begin to acquire directions. When three MAs line up in the same direction, the trader decides whether to enter the market or not. When the next candlestick closes above or below all moving averages, it is a signal to enter a buy or sell trade.

I should note that some traders use additional filters to supplement the Alligator, as it sends quite a lot of false signals in the sideways trend before the market determines the direction.

Alligator And RSI Strategy On 15 Minutes - Forex Strategy For Beginners - Alligator Indicator

, time: 18:44Alligator Indicator Trading Strategy PDF

12/13/ · The Williams Alligator indicator is a technical analysis tool that uses smoothed moving averages. The indicator uses a smoothed average calculated with a simple moving average (SMA) to start. It Alligator Indicator Settings. The Alligator indicator is created with three moving averages. These are simple moving averages set to five, eight, and 13 periods. These three moving averages created the jaw, lips, and teeth to create the alligator. Jaw – Blue Line: This is a 13 period SMA and is smoothed by eight bars on subsequent values The alligator indicator is one of the widely used trading indicators, which also acts as a trading system in itself. The alligator indicator was developed by Bill Williams in The name comes due to the fact that the indicator looks like an alligator’s jaws. Traders call this the Alligator indicator or Williams’ Alligator

No comments:

Post a Comment