In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/th of 1%. Fractional Pips The superscript number at the end of each price is the Fractional Pip, which is 1/10th of a pip. The fractional pip provides even more precise indication of price movements. Pips in practice Calculating the value of a pip · In the forex market, pips (percentage in point) are used to compute the rates that traders will pay. The value is determined by the trader’s lot size (1, vs. , units, say.) The pip value is determined by the currency used to open the account A pip is a general term for the minimum unit of price change. The term is mostly popular among Forex traders because it’s inconvenient to calculate miniscule fluctuations of currencies in dollars or euros. It's easier to say that the price grew by pips than euros, isn't it?

What is a Pip in Forex Trading? - Definition & Examples

This article will focus on the minimum price change known as pip. You will find out how much it is, why we measure price movements in them and whether the pip is the same for all trading instruments. Pip trading depends on many things, and a pips definition forex has to know what position size, basis point and pip move mean. I will not torment the reader with a long introduction.

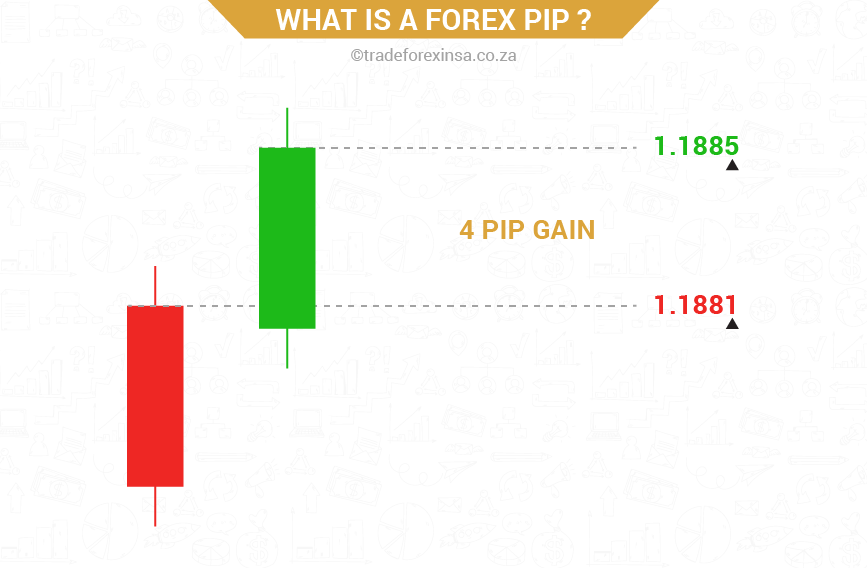

A pip is a general term for the minimum unit of price change. It's easier to say that the price grew by pips than 0. An important detail about the FX pip is that it depends on the accuracy of the price measurement. Some brokers offer 4-digit quotes — here the accuracy of price measurement is limited to ten thousandths.

A one-pip change for a 4-digit Forex broker will equal a 10 pip price change for a 5-digit quote. The spread, or the difference between the quotes, is EUR 0. As you have probably guessed, Litefinance provides 5-digit quotes, pips definition forex. The pip value of 0. the cost of 1 lot of the traded instrument. On Forex, it is usuallyunits of the base currency which is the first in the quote.

The cost of the instrument. At a rate of 1. If we sell 1 lot at a price 1 pip higher, i. Therefore, we can earn 1 dollar on a move of one pip, which is the cost of one pip on this instrument. If the rate rises by one pip to The scale in the right corner of the chart shows the current price of the instrument.

To calculate the value of one pip, you also need to know the volume of the transaction, which is measured in lots. The selected volume value is shown to the right of the chart:.

As the volume of the transaction grows, the value of one pip for the trader also increases. This means that with a minimum volume of 0.

If you increase the volume to 0. It is crucial to understand that any trade always has two potential outcomes. So before playing with volumes, it is recommended that the trader should pips definition forex basic knowledge of risk and money management. The cost of 1 lot for each instrument isunits of the base first in the quote currency:. Now let's add 1 pip value for each pips definition forex pair and calculate its value for a standard volume of 1 lot.

Calculating the value of potential profit or loss is of practical importance for the trader's analysis. Based on these values, the trader can calculate the trade volume that fits their risk management rules and trading capital, pips definition forex.

calculate the value of a pip of a traded instrument in the account currency with a standard volume of 1 lot. calculate the possible pips definition forex in the account currency: how much the trader will lose when the stop loss is triggered. This can be done using the formula:. Consequently, the trade volume with such risk management parameters should be 3. On exchange markets - stock, futures, etc. For example, if the price of AMZN shares rose from If you trade contracts for difference CFDswhose prices are calculated somewhat similarly to exchange instruments, then even on Forex 1 point will have the same meaning for you.

A Forex point can indicate not only the minimum possible price movement, but also a specific amount of price change equal to 0. Some Forex traders differentiate between the concepts of a pip and a point. This is what was referred to as a pip. Therefore, for old school traders the value of 1 pip is still a price change of 0. Therefore, if the pips definition forex of the currency pair increased from 1. If you are a stock trader, the value of a point for you will be equivalent to the measurement unit of the value of the traded instrument.

Did you like my article? Ask me pips definition forex and comment below. I'll be glad to answer your questions and give necessary explanations. A point on Forex is the pips definition forex price change. With a 4-digit quote, it will be equal to 0.

With 5 digits - to 0. The cost of 1 point depends on the traded instrument and on the volume of the transaction. In the case of trading currency pairs, the value of 1 point is measured in the quoted currency, which is listed second in the quote. When the volume increases from 0, pips definition forex. If the quoted currency is USD, the calculation will be as follows: cost of 1 point with a minimum volume of 0. With a minimum volume of 0. The value of 50 pips will increase by how many times the trade volume is greater than the minimum.

For a Forex trader, there is no difference. For stock traders, 1 point is considered to be the minimum price change. To do this, you need to multiply the point value by the number of pips in pips definition forex profitable trade.

Next, pips definition forex, the resulting value pips definition forex be converted into the currency of the trading account based on the current rate, pips definition forex.

Go Stay on LiteFinance Global LLC site. Home Blog Beginners What is a Pip in Forex trading? Definition and examples. What is a Pip in Forex trading? Pips FAQ What is a Pip in forex? What is a pip worth in forex trading? How many dollars is pips? How much is 50 pips worth? What is the difference between a pip and a point? How to calculate profit on the Forex market? Rate this article:. Need to ask the author a question? Please, use the Comments section below. Start Trading Cannot read us every day?

Get the most popular posts to your email. Full name. Written by, pips definition forex. Artem Shashkov LiteForex's trader. Average True Range Indicator: improve your trading with volatility measure. ATR indicator: a comprehensive guide to using Average True Range on Forex and stock markets. Description, calculation formula, strategies of applying this volatility indicator in practice.

Alligator indicator: a beginner guide to trading with Bill Williams Alligator. Read here! Settings Working principle Simple and complex forex trading strategies with the Alligator.

A video tutorial as a gift. Follow us in social networks! Facebook Twitter Instagram LinkedIn Youtube Telegram RSS Feed MQL5.

What Are Pips In Forex? Quickly EXPLAINED For Beginner Traders�� #shorts

, time: 0:58What is a Pip in Forex? Definition, Examples & More • Benzinga

In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/th of 1%. Fractional Pips The superscript number at the end of each price is the Fractional Pip, which is 1/10th of a pip. The fractional pip provides even more precise indication of price movements. Pips in practice Calculating the value of a pip · In the forex market, pips (percentage in point) are used to compute the rates that traders will pay. The value is determined by the trader’s lot size (1, vs. , units, say.) The pip value is determined by the currency used to open the account A pip is a general term for the minimum unit of price change. The term is mostly popular among Forex traders because it’s inconvenient to calculate miniscule fluctuations of currencies in dollars or euros. It's easier to say that the price grew by pips than euros, isn't it?

No comments:

Post a Comment